Table of Contents

- Ifta Fuel Tax Rates 2025 - Nicholas Reid

- How to Use – IFTA Reporting – My Fuel Tax

- IFTA Fuel Tax Program - for Truckers in the USA - YouTube

- Miles by state calculator helps IFTA tax reporting | TruckingOffice.com

- Form IFTA-101 - Fill Out, Sign Online and Download Printable PDF ...

- IFTA, Inc. International Fuel Tax Association

- 2nd Quarter 2024 Ifta Fuel Tax Rates - Jody Rosina

- IFTA Form - Fill Out and Sign Printable PDF Template | airSlate SignNow

- IFTA Fuel Tax Program - for Truckers in the USA - YouTube

- 3rd Quarter IFTA Tax Rate Changes for 2023! | by TruckLogics | Medium

What is IFTA?

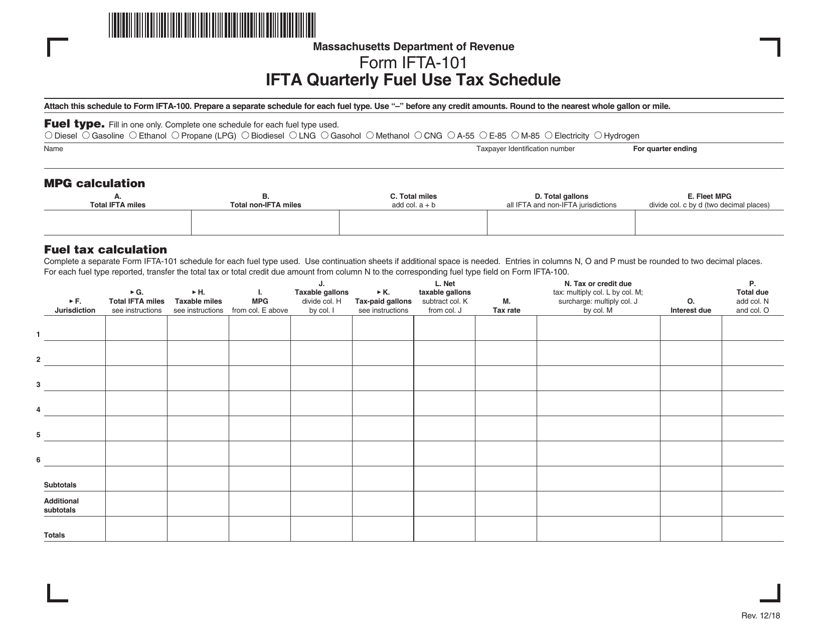

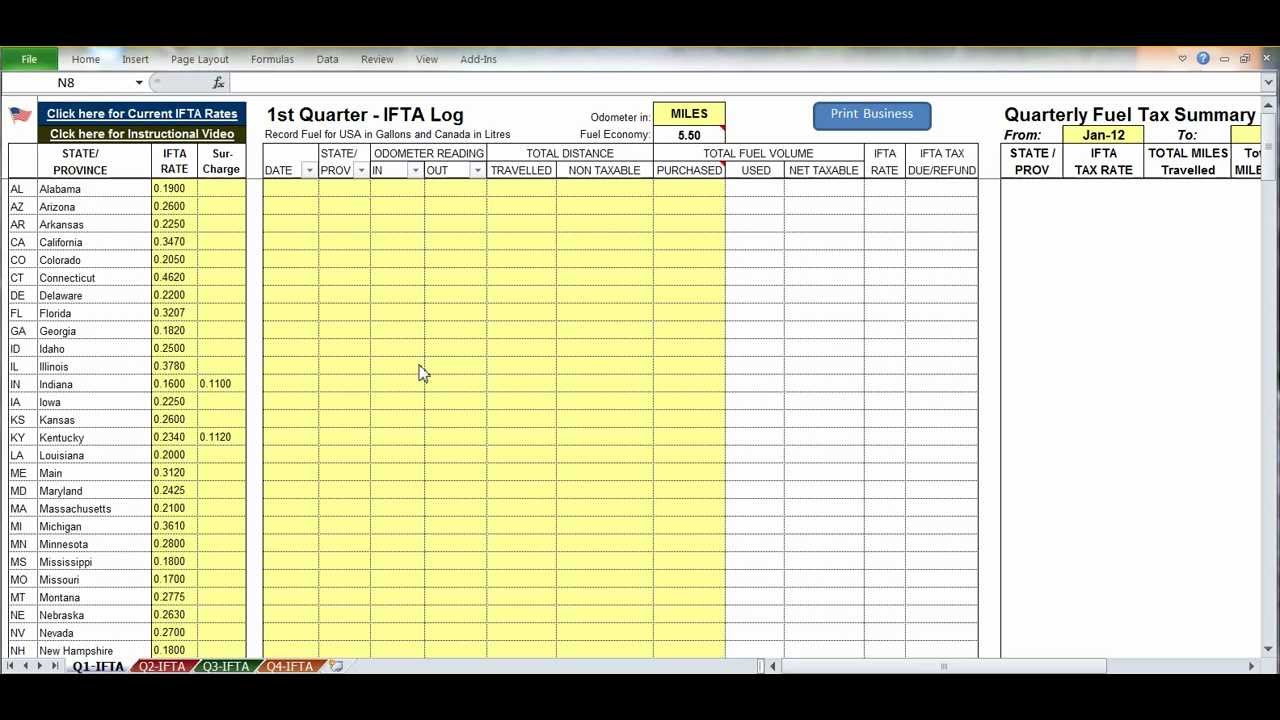

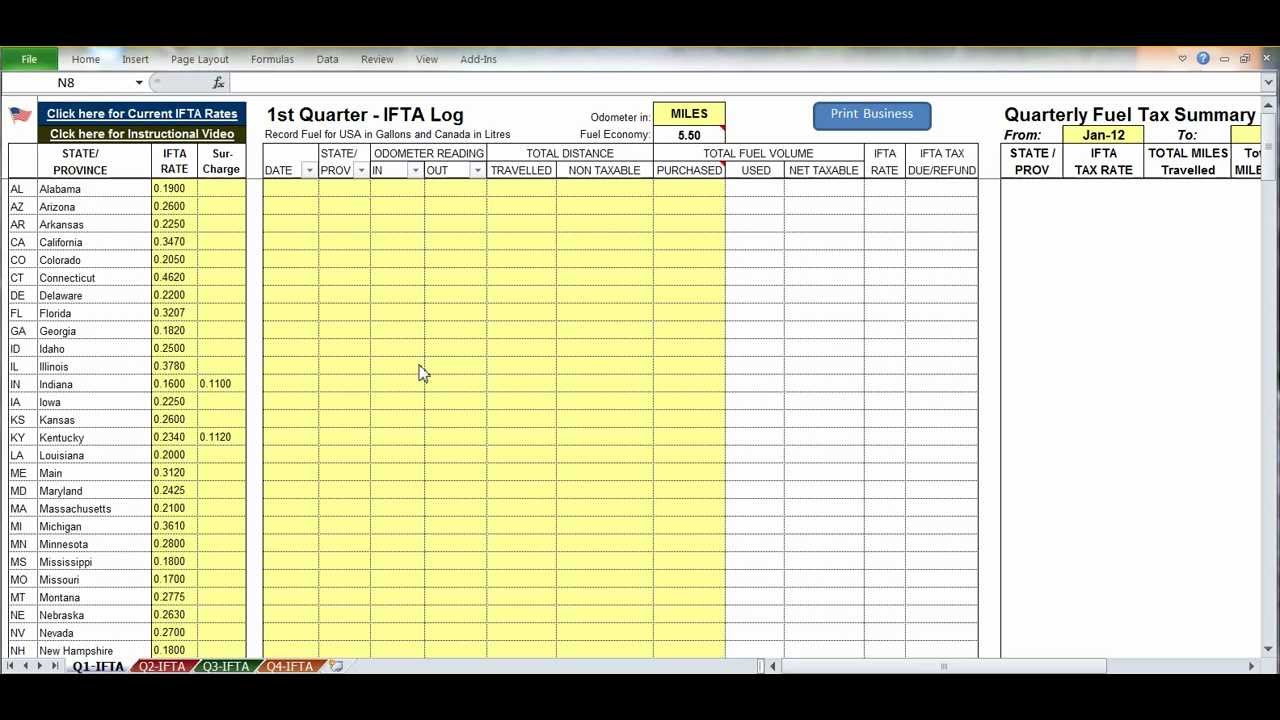

IFTA Quarterly Fuel Tax Schedule

FreightWaves Ratings: Insights and Expertise

FreightWaves, a leading provider of freight market analytics and intelligence, offers valuable insights and expertise on IFTA compliance. According to FreightWaves ratings, the key to successful IFTA management lies in: Accurate record-keeping: Maintaining precise records of fuel purchases, mileage, and vehicle information is crucial for accurate IFTA reporting. Timely filing: Submitting IFTA returns on time is essential to avoid penalties and interest charges. Compliance with regulations: Staying up-to-date with changing regulations and requirements is vital to ensure ongoing compliance.

Best Practices for IFTA Compliance

To ensure seamless IFTA compliance, carriers should: Implement a robust record-keeping system Designate a dedicated IFTA coordinator Utilize IFTA software or consulting services Stay informed about regulatory updates By following these best practices and staying on top of the IFTA quarterly fuel tax schedule, carriers can minimize the risk of errors, avoid penalties, and maintain a strong reputation within the industry. In conclusion, understanding the IFTA quarterly fuel tax schedule is crucial for carriers to ensure compliance and avoid penalties. By leveraging insights from FreightWaves ratings and implementing best practices, carriers can streamline their IFTA management, reduce administrative burdens, and focus on what matters most - delivering exceptional service to their customers. Stay ahead of the curve and ensure your IFTA compliance is on track by following the guidelines outlined in this article.Word Count: 500